THE MONEY JAR

SCOPE

Research

UI/UX Design

Customer Journey Mapping

SUMMARY

This project was developed with a focus on researching, planning and designing a mobile app that combines the fundamental aspects of a money management and banking app, specifically targeted toward college students. The aim was to develop an original approach to helping students evaluate their spending habits efficiently, initiate financial plans and set measurable and obtainable goals.

TEAM

Nura Husseini (UX/UI Design, Visual Design)Erika Park (UX/UI Design, Visual Design)

Financial Wellness

Re-Defined

Re-Defined

The most common challenge that young adults face as they embark onto independence is managing their money and developing sound financial wellness. There are endless resources and apps out there aiming to help people navigate these challenges. While developing the Money Jar, we wanted to focus on the needs of college students and young adults to develop their decision making skills when it comes to their spending, and how to make their money work for them as efficiently as possible while focusing on their education and other real-world responsibilities.

User-Centered Focus

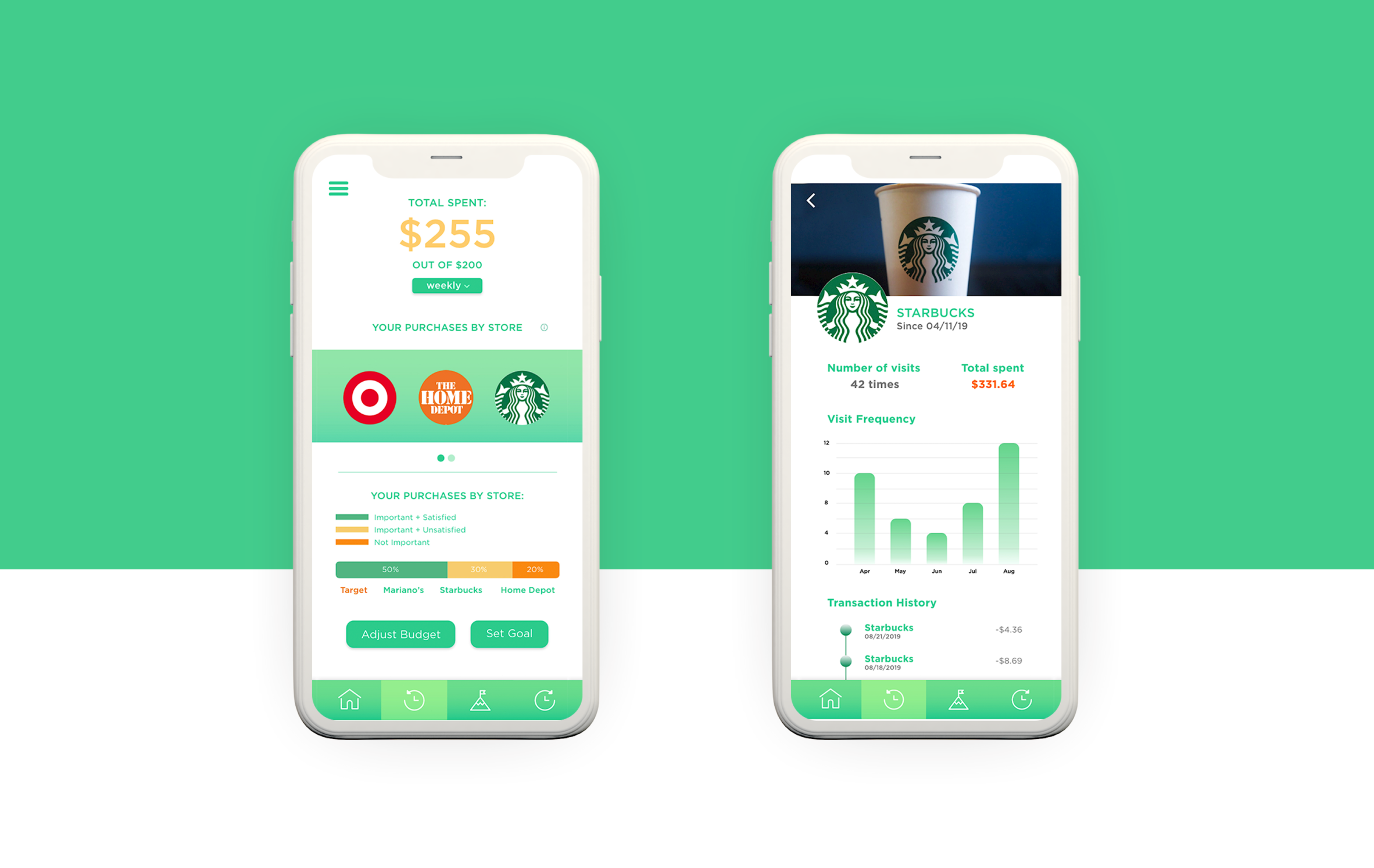

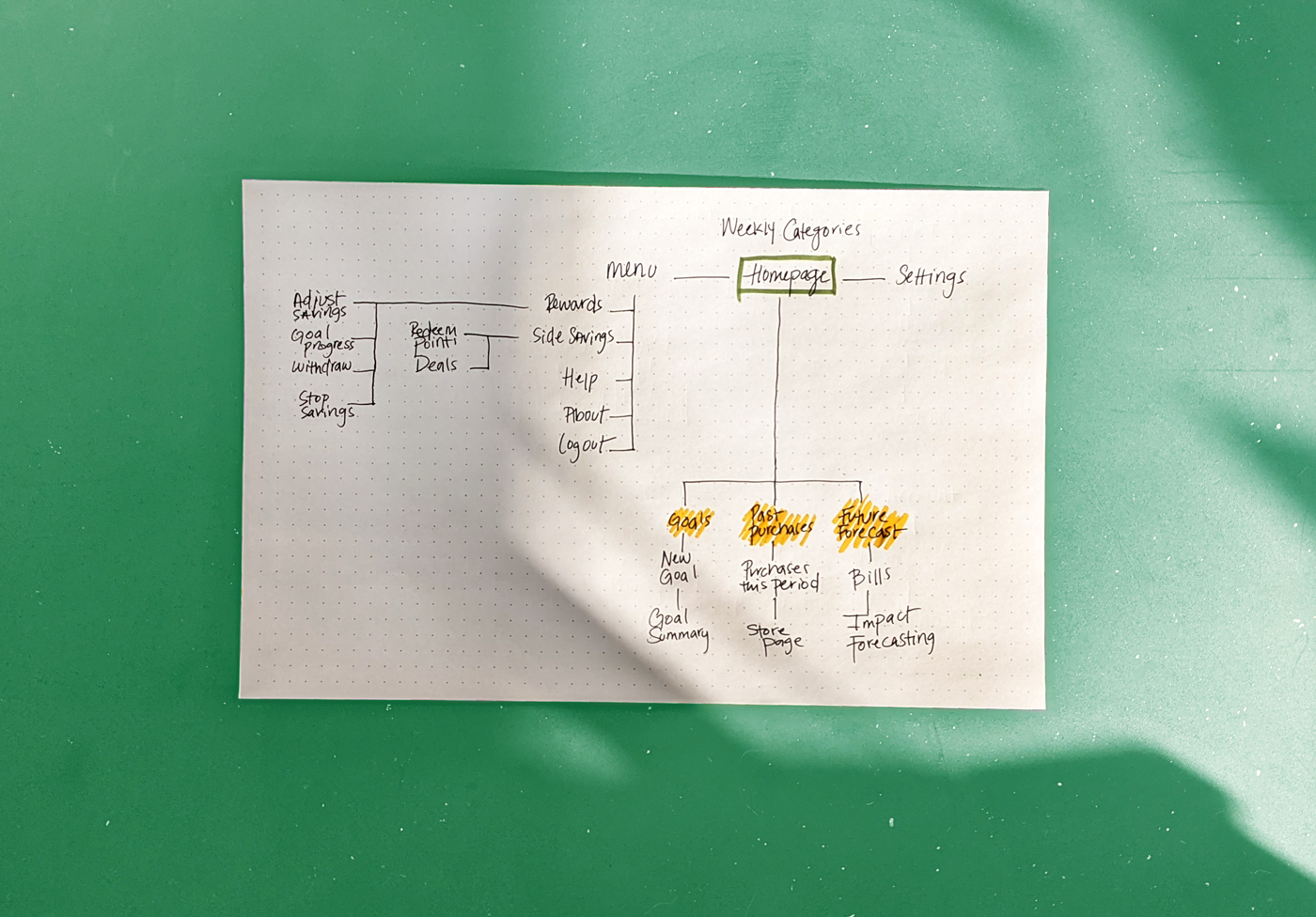

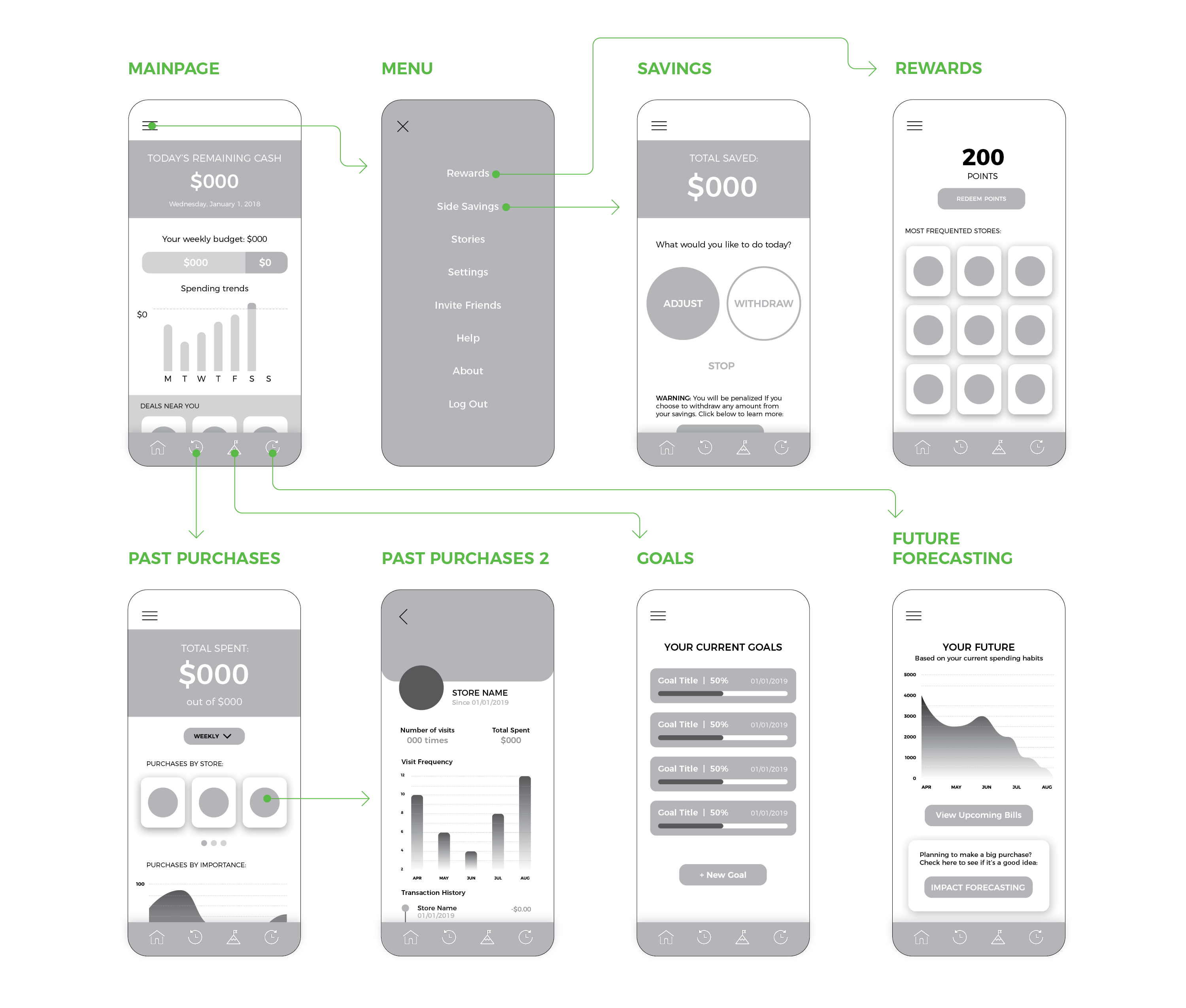

Our aim with the Money Jar is to provide the user with the tools they need to achieve financial wellness. We dove into the challenges college students face when planning their finances and we learned that it's often overwhleming for them to think about where to begin and how to plan for their future, especially while attending school and not having a steady source of income. Our solutions revolved around helping the user understand their current spending habits (by breaking down their Past Purchases), plan ahead for large expenses (through setting Goals), and forecast their financial future on a weekly, monthly and yearly basis according to recurring bills, spending patterns, events and holidays (through Future Forecasting). In addition to that, we emphasized positive re-inforcement and stories as secondary tools to educate and encourage users to make healthier financial decisions.

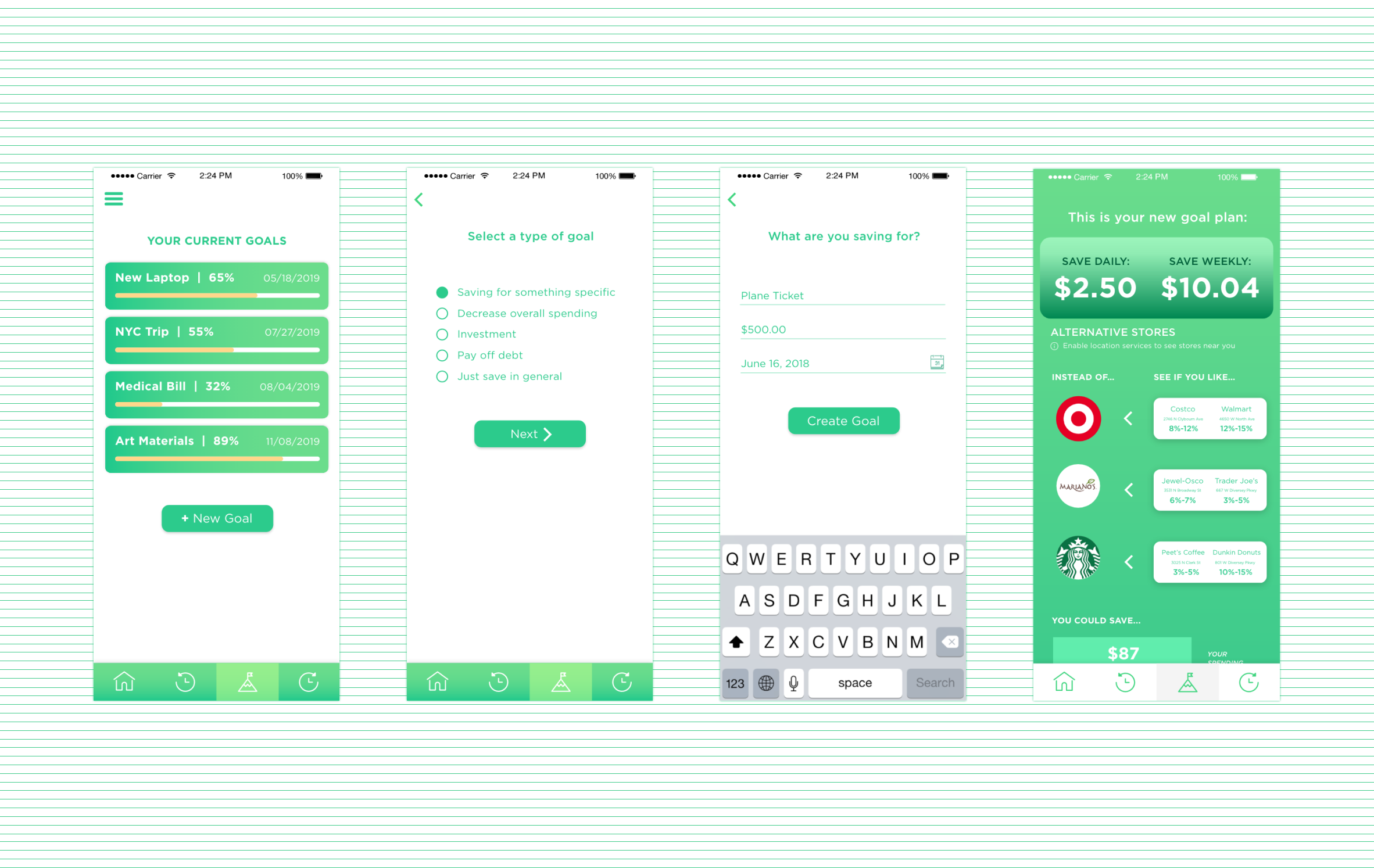

Setting Financial Goals

The Goals feature allows users to set as many goals as they would like and receive a detailed plan on how to achieve their financial objectives with specific suggestions curated based on their spending patterns, purchase history, events, holidays and recurring bills.

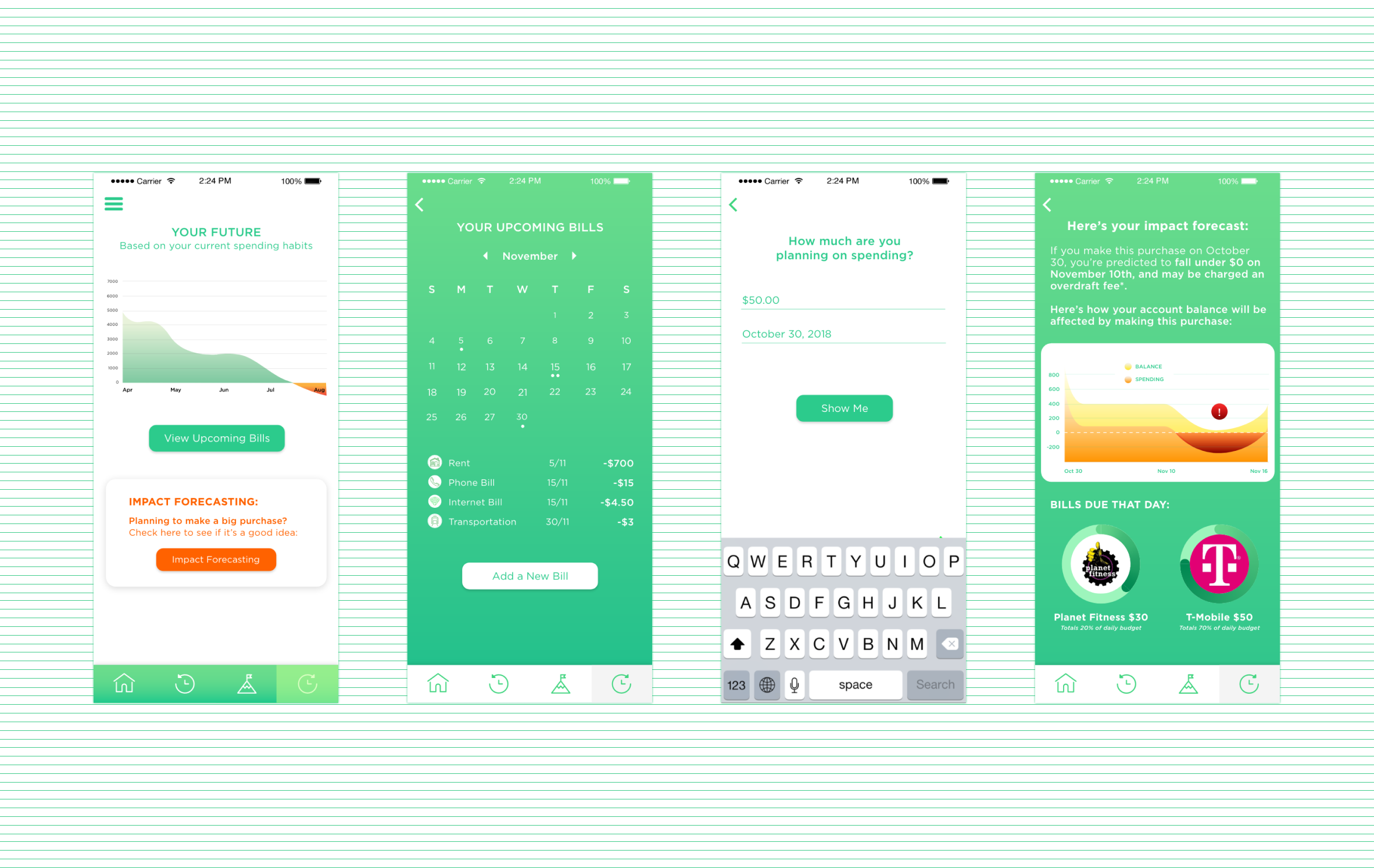

Seeing into the Future

The Future Forecasting feature allows users to make better financial decision by forecasting their future financial health. It helps users plan their expenses ahead of time, and see how their desired purchases could impact of purchses on their future financial wellbeing.